Most people who have never heard of the 70% rule are quick to dismiss it as a scam. They may be right, but they’re also wrong. The 70% rule is an investment strategy in the real estate world that has been around for a while now. It makes a lot of sense for those who invest in hard money loans or other of property flipping projects.

What is the 70% Rule?

The 70% rule states that you buy a house for 70% of its market value and then sell for more. For example, $100k purchase price, $70k loan amount, $140k sales price). This allows investors to take on less risk and still make money. Many real estate investors use this rule to calculate estimated repair costs, the repair value, selling costs, a property’s ARV, and potential profit margin.

How Do You Choose the Right Investment Property?

When deciding on a house flipping deal, there are certain factors the house flipper must consider to ensure he gets a good deal. After performing a detailed analysis of the local market for purchasing the distressed property, as well as considering repairs needed, renovation costs, buying costs, holding costs, and closing costs, the investor will then be able to determine the maximum purchase price for the property.

The investor should also consider his repair budget and decide on how much he is willing to spend in order to get a better return on investment (ROI). The profit margin largely depends on the work that needs to be done, the size of the project, and the condition of the property.

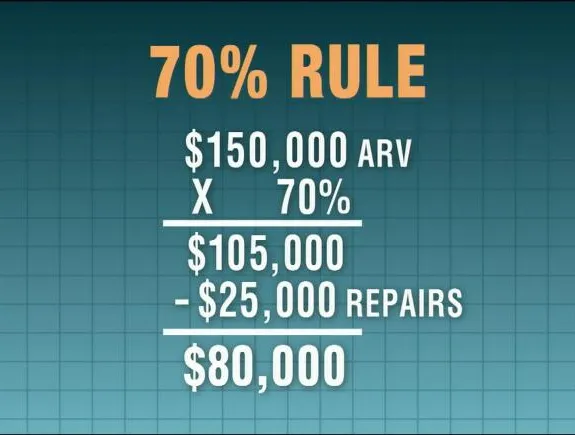

How Do You Calculate the 70% Rule?

To calculate the 70% rule, you divide the cost of your investment by one plus what percent profit you want to make. For example, let’s say you’re looking at a property that costs $100k and needs $30k worth of repairs. In this scenario, the total investment is now 70%.

Are Financing Costs Accounted For Using the 70% Rule?

The 70% rule formula states that the profit is calculated by subtracting the total purchase costs from the total sales price, leaving 70% of the price for profit. However, it’s essential to remember that this equation doesn’t include hard money financing costs, which must be repaid before any profits can be realized.

Who Should Use the 70% Rule?

Real estate investors, commonly referred to as fix and flip investors, find the 70% rule to be a valuable tool, especially when purchasing a property with the intention of flipping it for profit. The 70% rule is less relevant for a family looking to buy their first home. They are buying the property as an investment, but it’s not

one they plan on house flipping in order to make money. The most important thing to remember is the number one rule in real estate – location, location, location. Households with a lower income have less money to spend on repairs and can’t buy more expensive properties which means they are typically not in as high of demand for reselling or flipping.

Do Real Estate Investors Benefit from Using the 70% Rule?

As a real estate investor, using the 70% rule can be a great way to invest in property without taking on too much risk. Given the rising costs of inventory, it’s important for investors alike to find ways to limit their risks and still make money.

Does a Real Estate Agent Benefit From Working With an Investor?

The real estate market is a tricky one to navigate. All the lingo and unfamiliar terms that are frequently thrown around can easily confuse novice investors.

The 70% rule is an example of something that can be really hard to wrap your head around if you don’t know what it means. The good news, though, is that it’s not too difficult to understand.

Essentially, the 70% rule dictates how much money you can borrow for a property in order to make your investment profitable. This means that if you have $100,000 left over after paying off all of the purchase costs, then at most you can only borrow up to 70%.

Using a real estate investor’s 70% rule is a good way to make sure that you’re not over-extending yourself when buying properties. This can save you from foreclosure or bankruptcy in the event of an unexpected downturn. As a real estate agent, using an investor is advantageous because using this rule, when applied properly, will help maximize profits.

To find out more about our hard money loans, contact us today!